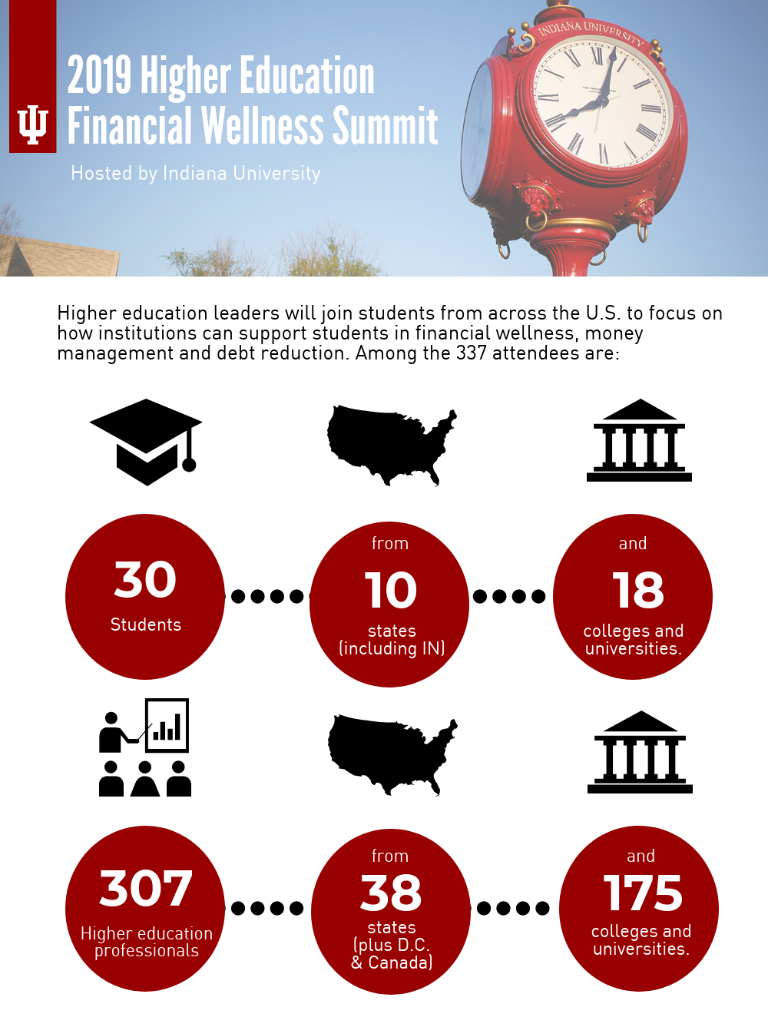

Indiana University will host representatives from more than 175 institutions across the nation for the 2019 Higher Education Financial Wellness Summit.

The July 14-16 event, organized largely by representatives from IU, will focus on how higher education institutions can best help students understand their finances, gain a sense of financial wellness, manage money and avoid excessive debt. It will also engage university leaders in serious and thoughtful conversations regarding the future of federal financial aid.

The summit is the largest gathering of its kind and will include a student symposium, the Higher Education Financial Wellness Student Experience, sponsored by the IU Office of the Bicentennial on July 13. It is the first time in the summit’s six years of existence that it will be offer students opportunities to learn alongside professionals and drive discussion about how to build and expand financial wellness and education efforts on college campuses.

“We’re excited that we get to bring the Higher Education Financial Wellness Summit to Indiana University,” said Phil Schuman, co-chair of the summit and director of financial literacy at IU. “The new student experience symposium is a great step forward in supporting students and bringing them into the conversation about the critical financial issues they face.”

Isaac Irvin, a junior studying economic consulting in the IU Kelley School of Business, is one of 30 students who will participate in the student symposium. He said he is looking forward to networking with students from other universities.

I’m hoping to get to know other students and see what’s working and what’s not on their campuses and learn about what we can do to help support our peers,” he said.

Irvin, who will work as a peer financial educator in the IU MoneySmarts office this fall, said financial wellness education is essential for college students.

“There needs to be a space for young people to be taught about how to manage money and how to go from their education and on to a career without being crippled by debt and finances,” he said.

In addition to the new student experience symposium, the summit will feature talks by national experts as well as workshops and breakout sessions on financial literacy and what institutions of higher education can do to promote financial wellness.

Keynote speakers include:

- Paola Hernandez Barón, well being consultant in the Office of Financial Literacy at IU.

- Joshua Becker, author of “The Minimalist Home,” “The More of Less,” “Clutterfree With Kids” and “Simplify,” and co-creator of Simplify Media, the parent company of Simplify Magazine and Simple Money Magazine.

- Helen Colby, assistant professor of marketing at the Kelley School of Business on the IUPUI campus.

- Zach Taylor, research assistant in the Department of Educational Leadership and Policy at the University of Texas at Austin.

Hernandez Barón will draw from her personal experience navigating finances and discuss how internal factors, such as our identities and world view, and external factors, including systemic barriers, influence our understanding of money and financial decisions.

“It’s very important for us have a conversation about the role of higher education institutions in preparing students for their financial future and the different factors that influence students’ college experience, life satisfaction and overall wellness,” Hernandez Barón said. “Having these intentional conversations helps us take a more holistic approach to students. By addressing the role of mental health and multicultural components, we can help better prepare people in their financial journey.”

IU is a leader in financial literacy and affordability initiatives among higher education institutions. IU’s creation of MoneySmarts in 2012 and its initiative to send annual debt letters to all borrowers about their student loans has become a model for legislation adopted in 12 states. It is also cited as a best practice by the U.S. Financial Literacy and Education Commission.

IU has seen a downward trend in overall amounts and numbers of student loans since the 2011-12 academic year. Both federal and private loans are down 19 percent, accounting for $126.4 million less in borrowed money. These results coincide with IU’s emphasis on ensuring students are informed about their debt.

IU also launched MoneySmarts U in 2017. The online financial literacy platform features 21 courses in financial education. The courses are segmented by a student’s year in school, a population in which a student might identify (e.g. international student) and specific financial topics (e.g. debt). The program also features a course for parents of college students. All first-year students at IU are required to complete the program’s first-year course.

Through banded tuition efforts, IU has also encouraged students to graduate in four years by taking at least 15 credit hours per semester. IU Bloomington has furthered its commitment to helping talented students access higher education through its participation in the nationwide American Talent Initiative, which focuses on helping academically talented low- and moderate-income students to access colleges and universities with high graduation rates.